Quick update on Evergrande. Here’s the best run down I’ve found so far:

The points I found interesting:

The main real estate policy intervention thus far has been “Three Red Lines”. Those are:

70% ceiling on liabilities to assets, excluding advance proceeds on pre construction sales

100% cap on net debt to equity

Cash to short-term borrowing ratio >1

The Three Red Lines intervention was pretty recent - 2020 - so it’s not crazy to think of Evergrande as a somewhat intentional casaulty of those regulations

Evergrande is unique becasuse of its size, but not really in the way it does business or how it got into this position

Part of the run up in real estate prices came from the Shanty Town Redevelopment Program. It worked as such:

Step 1: Relocate people living in slums

Step 2: Demolish the slums

Step 3: Pay those relocated people to buy new housing

The main purpose of the program was as an antidote to the previous real estate crash but the housing effects shouldn’t be understates

Pre-construction sales generate 100% of the list price. This is not the future because the buyer behavior was predictated on prices going up

Also, preconstruction sales are how these firms have been staying solvent. Also, this isn’t the future how these firms will stay solvent. I’m a little confused on the mechanics here because the first bright line should exclude this advance proceeds revenue but that’s why God created CFO’s

Insiders fall into two camps right now:

Real estate is a quarter of the PRC economy so there’s no way CCP lets these instutitions fail and risk missing their GDP growth targets

The crackdown on tech, crypto, tutoring firms shows that CCP leadership gives no fucks about the economic consequences of their policy interventions

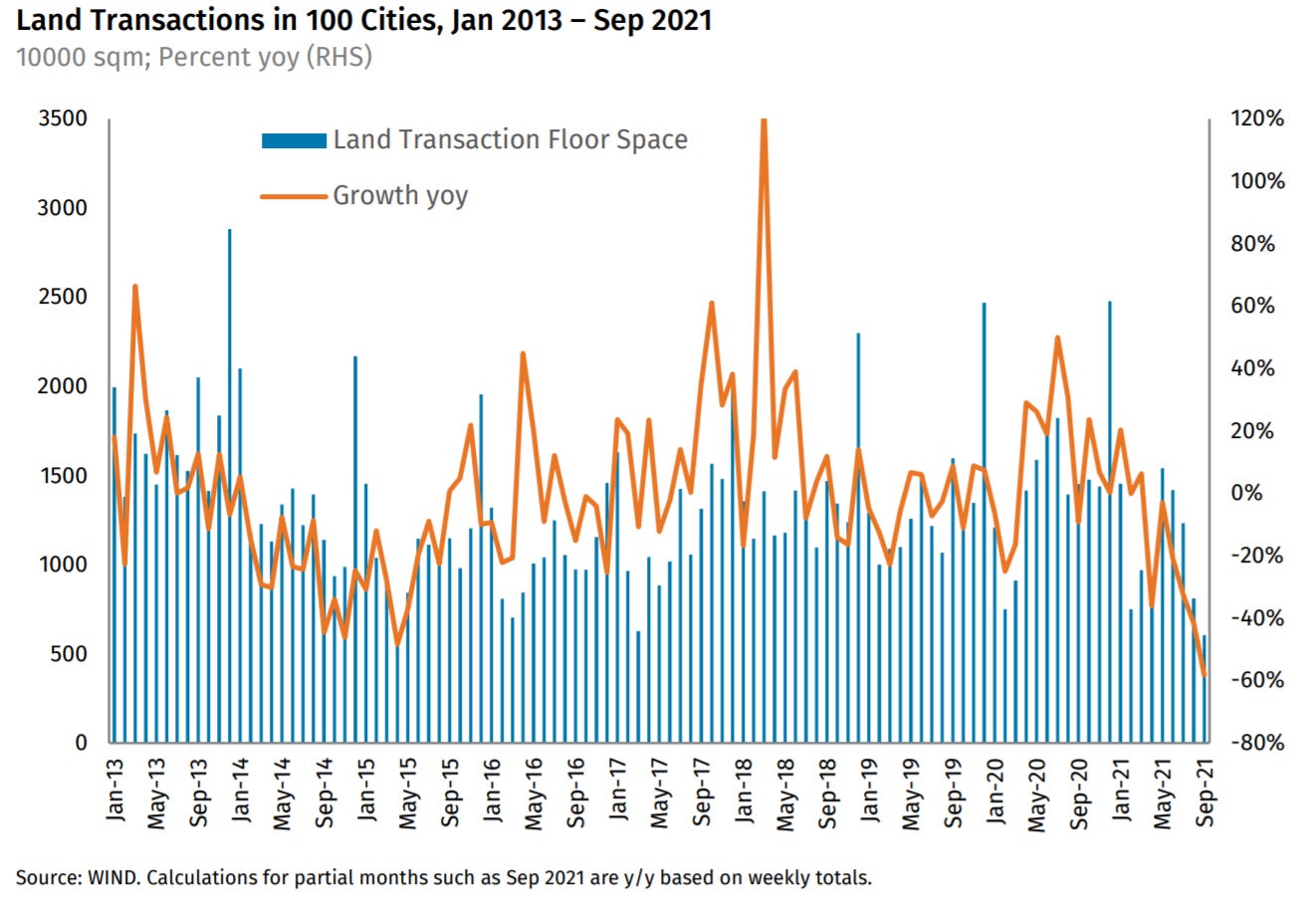

Land transactions have taken a huge hit. See below:

The second order casaulties are going to be driven by decline in land sales. Specifically, those are local government financing vehicles who never had a “Three Bright Lines” moment and the smaller commercial banks who lend to them

The very credible Michael Pettis provides a reserved perspective in this thread:

Some high points:

“[…] foreign investors still play a small role in China's onshore stock and bond markets, and anyway the vast majority of bonds held by foreigners are Chinese government bonds, which are unlikely to be affected by an Evergrande crisis.”

“[…]we will see the reduction in real-estate investment countered by an increase in local government spending.”

PRC’s most recent bond issue was wildly oversubscribed so, yes, the government has the dry powder to put to work. If the next crisis originates from the Chinese debt markets, we will point back to this data point as the moment everyone should’ve known better.

Also - is this fundraise the newest, worst thing ever to happen to the USD as global reserve currency?

I don’t want to say the Evergrande-as-global-contagion story is over but let’s just say the Evergrande chapter of the Chinese debt crisis looks to be outlined, written, and awaiting editor review. Someone smarter than me will have to figure out who’s the next cowboy in this rodeo.